January 23, 2026

Global AI search engine market share

Estimating the global market share of traditional search and AI search

Background

The introduction of Large Language Models (LLMs) is the biggest shift in web search since Google’s launch in 1998. AI search engines like ChatGPT don't just find links - they analyze web pages. This means marketing teams must now optimize for both humans (SEO) and machines (GEO: Generative Engine Optimization).

In this new era, marketing teams must optimize content for humans (SEO), but also for machines - this is known as Generative Engine Optimization (GEO) or Answer Engine Optimization (AEO).

Because time and resources are finite, marketing teams need to know where users are. In this post, we answer the following questions:

How important is traditional search compared to AI search?

What is the market share of the different AI search engines?

Methodology: The Problem with Click Data

Existing data on this is often misleading. According to data from Ahref’s AI vs Search Traffic Analysis tool, ChatGPT has 0.21% of global search traffic and Google has 39.98%. This means that Google is 190x more important than ChatGPT.

However, comparing clicks is the wrong metric. Google Search is designed for users to click links. Conversely, AI search engines are designed to provide the answer immediately, removing the need to visit the web page.

The better metric, therefore, is web sessions: how many times did a user sit down to research a product or service you could be offering - and did so using either Google Search or an AI assistant. We get this data for desktop and mobile web sessions from Similareb, averaged over three months from October to December 2025.

How important is traditional search vs. AI search?

The first question is: How many people are still using traditional Google Search? The overwhelming majority. Based on data from Similarweb about the number of daily web sessions (both desktop and mobile), we get these results:

Google Search: 2.80 billion daily web sessions (94.80%)

All AI search engines: 277 million daily web sessions (5.20%)

While the 5% figure for AI search seems small, it is growing rapidly. Furthermore, Google embraces the future of AI search and started a process of internal cannibalization: AI Overviews (AIO) and AI Mode (AIM) are subsets of the traditional search experience, while Gemini remains a standalone product.

Estimating Google’s AI Traffic

Google does not publish separate traffic numbers for AI Overviews or AI Mode. However, we can estimate how much of Google's 2.8 billion daily web sessions are now AI-infused by either AIO or AIM.

Based on Semrush’s 2025 study, 16% of Google Search queries now trigger an AI Overview. Since the average Google session consists of roughly 8.61 queries, we can calculate the probability of a user encountering at least one AIO during their visit is 1 - (1 - 0.16)^8.61 = 78%.

This means 78% of all Google Search sessions now include at least one AIO. This has massive implications since traditional "blue links" are being pushed further down the page, and organic click-through rates (CTR) drop.

Estimating AI Mode (AIM) Traffic

For AI Mode, we have a direct data point. In its Q3 2024 earnings call, Google disclosed that AI Mode has 75 million daily active users (DAU). Given the slow adoption of AI Mode, we think that Google essentially reported “every day, some 75 million people are using AI Mode”. Therefore, we use a conservative assumption of one AIM session per user per day. This yields 75 million AIM sessions per day, 2.6% of Google's total search footprint.

Here is a breakdown of Google's search properties in absolute numbers: daily web sessions (millions) and percentage of overall Google search footprint:

Property | Daily Sessions (millions) | Share of Total |

Google Search (Total) | 2,797 | 98.3% |

↳ thereof AIO sessions | 2,174 | 76.4% |

↳ thereof AIM sessions | 75 | 2.6% |

Google Gemini (standalone) | 47 | 1.7% |

TOTAL | 2,844 | 100% |

In the future, we expect Google to merge AIM into Gemini, creating a unified AI search engine. In the next step, let's exclude traditional search (Google Search + AIO), and focus only on AI assistants.

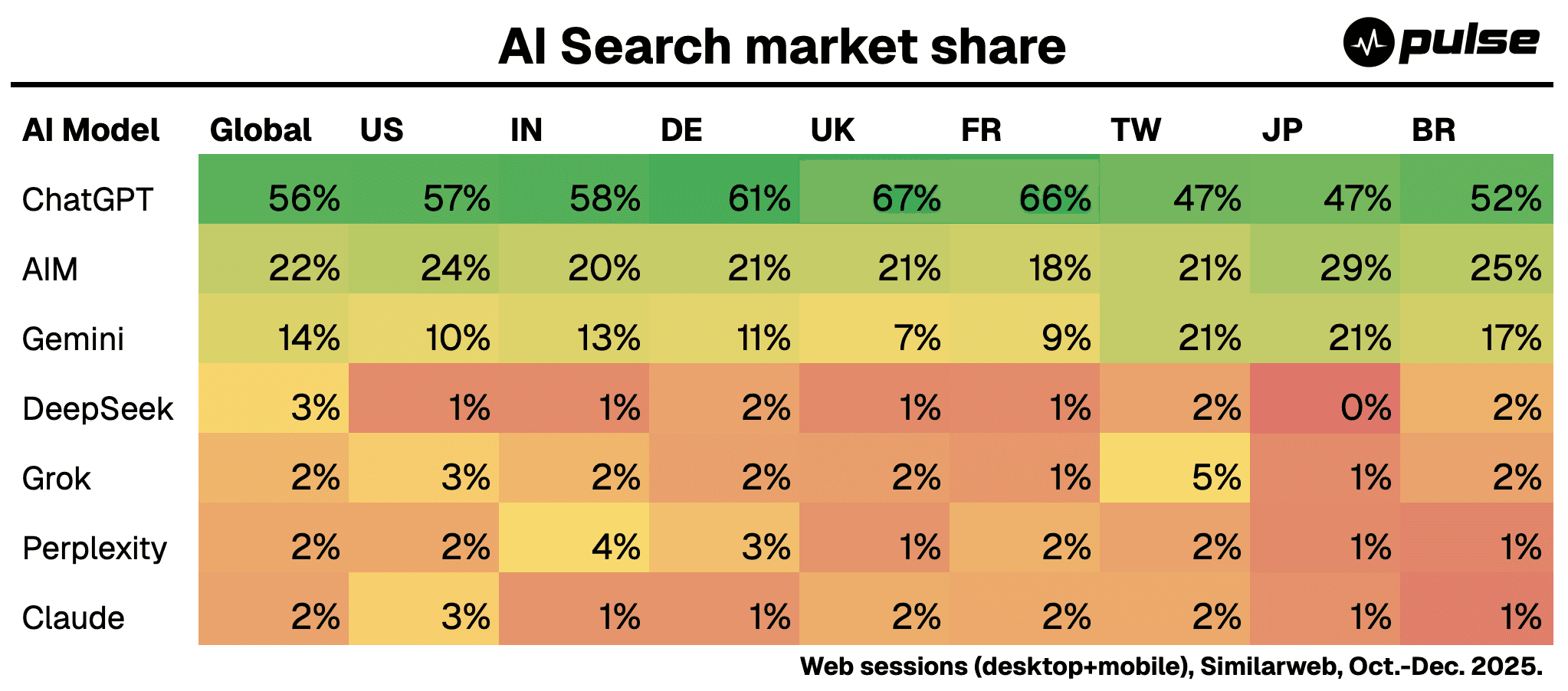

What AI search engines are the most important?

The following table shows the absolute number of daily AI web (millions) sessions by model and country:

Model | Global | US | IN | DE | UK | JP | BR |

ChatGPT | 194.73 | 33.84 | 17.49 | 6.31 | 8.41 | 7.28 | 9.09 |

AIM | 75.00 | 14.60 | 6.10 | 2.15 | 2.61 | 4.54 | 4.39 |

Gemini | 47.43 | 5.95 | 3.76 | 1.11 | 0.87 | 3.30 | 2.96 |

DeepSeek | 11.44 | 0.68 | 0.33 | 0.19 | 0.13 | 0.02 | 0.38 |

Grok | 7.89 | 1.78 | 0.73 | 0.18 | 0.20 | 0.17 | 0.31 |

Perplexity | 6.53 | 1.15 | 1.28 | 0.27 | 0.16 | 0.15 | 0.15 |

Claude | 6.11 | 1.84 | 0.40 | 0.14 | 0.27 | 0.19 | 0.12 |

While absolute traffic shows the scale, the relative market share reveals the competitive landscape within each country. The following heatmap visualizes the market share for the 277 million daily AI web sessions, normalized by country. This represents the share of AI searchers who choose a specific model when they move beyond a standard Google Search bar.

Key Observations:

ChatGPT's Global Grip: OpenAI holds 56% market share globally, peaking in the UK and France.

Google's Rapid Scale: By leveraging the existing Search user base, AIM has quickly become the second-most used AI search tool globally (22%).

The Japanese Market: Taiwan and Japan are outliers: ChatGPT has only 47% and Google has product-parity with AIM and Gemini being head to head.

The "Long Tail": Despite high media visibility, specialized tools like Perplexity and Claude currently capture less than 2% of global search sessions each.

The Bottom Line

Although Google Search remains massive, it's no longer a traditional search engine. It's an AI-first interface where 80% of sessions show AI-generated content, leaving only 22% as "traditional" search.

The market for AI search engines is currently a two-horse race, with ChatGPT (56%) and Google’s AI ecosystem (35%) capturing over 90% of global conversational traffic.

As Google continues to infuse AI into its core experience through AIO and AIM, and users rapidly migrate toward pure AI search engines, a legacy SEO strategy is not good enough. If marketing teams are not optimizing for AI, they are ignoring where many current and most future users are.

Sources

Semrush.com, 2025.

Google Q3 2024 earnings call, 2024.

Similarweb, web session data, desktop+mobile, Oct.-Dec. 2025.